USDT Portfolio Rebalancing: Maintaining Stability in a Dynamic Market

As digital asset portfolios evolve, maintaining balance becomes essential. USDT portfolio rebalancing is a structured approach that helps investors adjust allocations over time, ensuring that risk levels, liquidity, and return objectives remain aligned with long-term goals.

What Is USDT Portfolio Rebalancing?

USDT portfolio rebalancing involves periodically reviewing and adjusting how USDT is distributed across different investments. Instead of reacting to short-term market movements, rebalancing focuses on restoring target allocations when deviations occur.

Why Rebalancing Matters for USDT Strategies

Even with a stablecoin base, portfolio weights can shift due to varying yield rates, lock-up periods, or changing platform conditions. Regular USDT portfolio rebalancing helps prevent overexposure to any single strategy or platform.

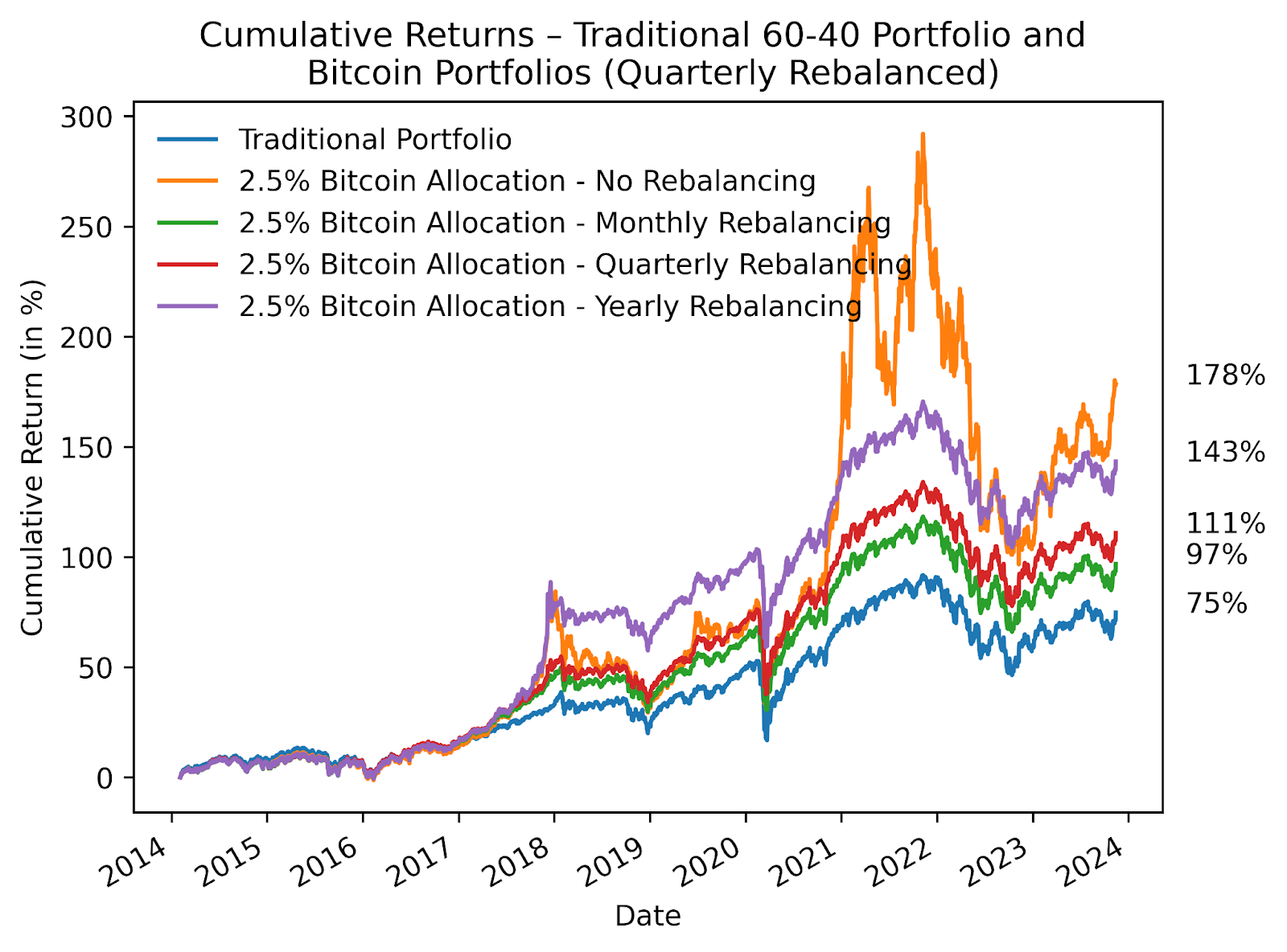

Timing and Frequency Considerations

Rebalancing can be scheduled at fixed intervals or triggered by predefined thresholds. A disciplined schedule reduces emotional decision-making and keeps the portfolio aligned with its intended structure.

Managing Risk and Liquidity Through Rebalancing

By reallocating USDT between liquid and higher-yield positions, investors can maintain flexibility while optimizing income potential. This balance is especially important when market conditions or personal financial needs change.

Supporting Long-Term Portfolio Health

Over time, USDT portfolio rebalancing improves consistency and resilience. It allows investors to adapt strategies without unnecessary disruption, reinforcing stability and efficiency in capital management.

Conclusion

USDT portfolio rebalancing is a vital tool for maintaining control in stablecoin-based investing. Through regular review and thoughtful adjustment, investors can preserve balance, manage risk, and ensure their USDT portfolio continues to perform as intended.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...