USDT Mining Cost: Understanding Expenses in Stablecoin Earning Models

When evaluating any earning system, cost is just as important as potential returns. In the case of USDT mining cost, the structure differs significantly from traditional crypto mining. Instead of hardware and electricity, costs are tied to platform mechanics, capital allocation, and opportunity considerations.

What Does “USDT Mining Cost” Actually Mean?

USDT mining cost does not refer to physical expenses like GPUs or power consumption. Since USDT is not mined through proof-of-work, the primary costs are non-physical. These include platform fees, participation conditions, and the cost of locking capital for a period of time.

Platform and Service Fees

Many USDT mining systems charge fees for participation, management, or reward distribution. These costs may be presented as percentages, fixed service charges, or built into return calculations. Understanding how and when fees are applied is essential for accurately assessing net outcomes.

Opportunity Cost of Capital

One often-overlooked USDT mining cost is opportunity cost. When USDT is allocated into a mining-style system, it may be unavailable for other uses. Even if returns are stable, users should consider what alternative strategies they are giving up during the participation period.

Liquidity and Access Considerations

Some USDT mining models restrict withdrawals until a cycle is completed. While this can support predictable returns, it introduces a cost in terms of flexibility. Limited access to funds can be a meaningful trade-off, especially during changing market conditions.

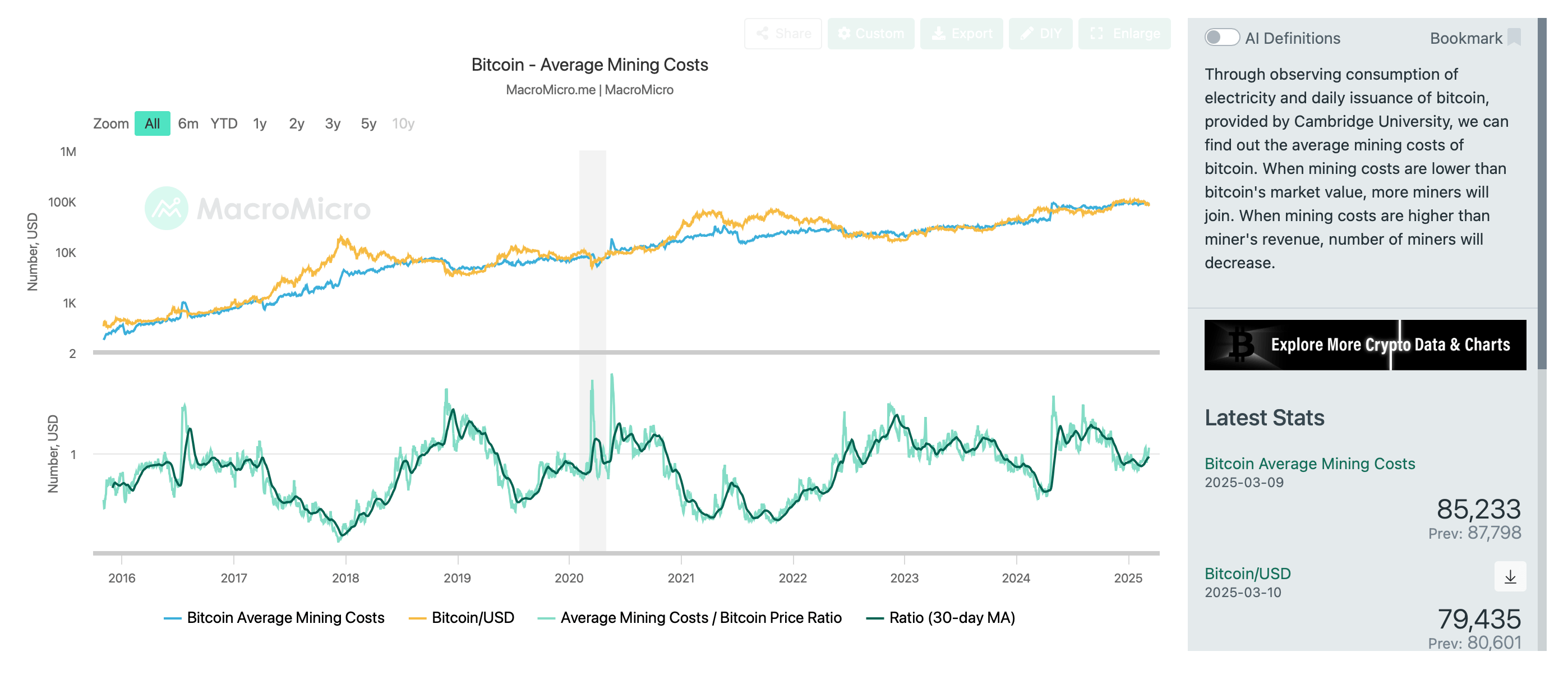

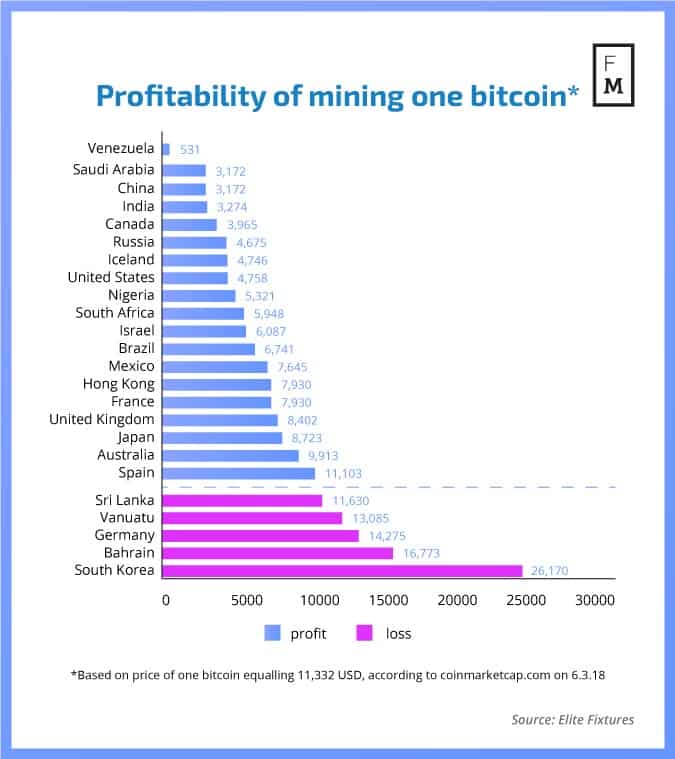

Comparing Costs to Traditional Mining

Traditional mining involves upfront hardware investment, ongoing maintenance, and energy expenses. In contrast, USDT mining cost is generally lower and simpler, but it shifts the focus toward system transparency and rule clarity rather than physical efficiency.

Evaluating True Cost vs. Advertised Returns

A system with attractive returns may still be inefficient if costs are hidden or poorly explained. Evaluating USDT mining cost means looking beyond headline numbers and understanding how fees, restrictions, and capital usage affect overall performance.

Conclusion

USDT mining cost is less about machines and more about structure. By examining fees, liquidity limits, and opportunity cost, users can better understand what they are truly paying to participate. In stablecoin earning models, informed cost awareness is a key factor in long-term sustainability.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...