TRX Crypto Lending Returns: Maximizing Income in the TRON Ecosystem

As decentralized finance (DeFi) grows, TRX crypto lending returns have become a popular way for investors to generate passive income. By lending TRX tokens on secure platforms, users can earn interest while contributing to the liquidity of the TRON blockchain ecosystem.

What Are TRX Crypto Lending Returns?

TRX crypto lending returns refer to the interest earned by lending TRX tokens to other users or platforms through decentralized or centralized lending services. Returns are calculated based on the loan amount, duration, and platform-specific rates.

How TRX Crypto Lending Works

Deposit TRX

Investors deposit their TRX into a lending platform or smart contract.Lending to Borrowers

The platform allocates tokens to borrowers who pay interest according to agreed terms.Earning Returns

Lenders receive interest periodically, often compounded automatically, boosting TRX holdings over time.

Factors Affecting TRX Lending Returns

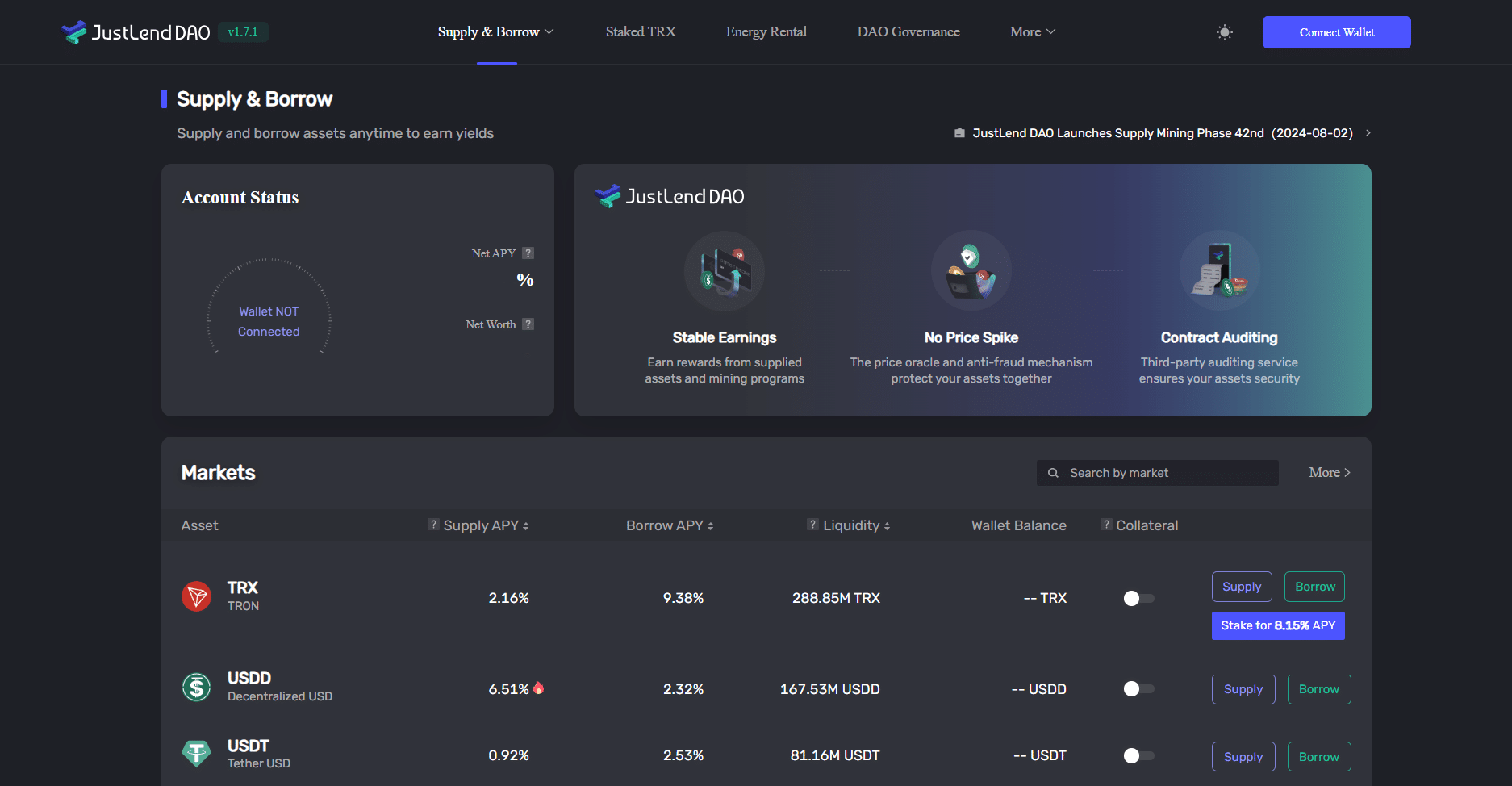

Platform Type: Centralized platforms may offer slightly lower yields but higher security, while decentralized platforms may provide higher returns with increased risk.

Loan Duration: Longer-term lending may offer higher interest rates.

Market Demand: Rates fluctuate based on borrowing demand for TRX or other TRON-based tokens.

Collateralization: Loans are often collateralized, reducing default risk and affecting interest rates.

Benefits of TRX Crypto Lending

Passive Income: Earn consistent returns without active trading.

Liquidity Contribution: Supports the TRON ecosystem by providing capital for borrowers.

Flexible Participation: Many platforms allow variable deposit amounts and flexible terms.

Compounding Opportunity: Reinvesting interest can significantly enhance portfolio growth.

Risks to Consider

Platform Security: Ensure the platform has audited smart contracts and strong security measures.

Borrower Default Risk: Even with collateral, unexpected events could impact returns.

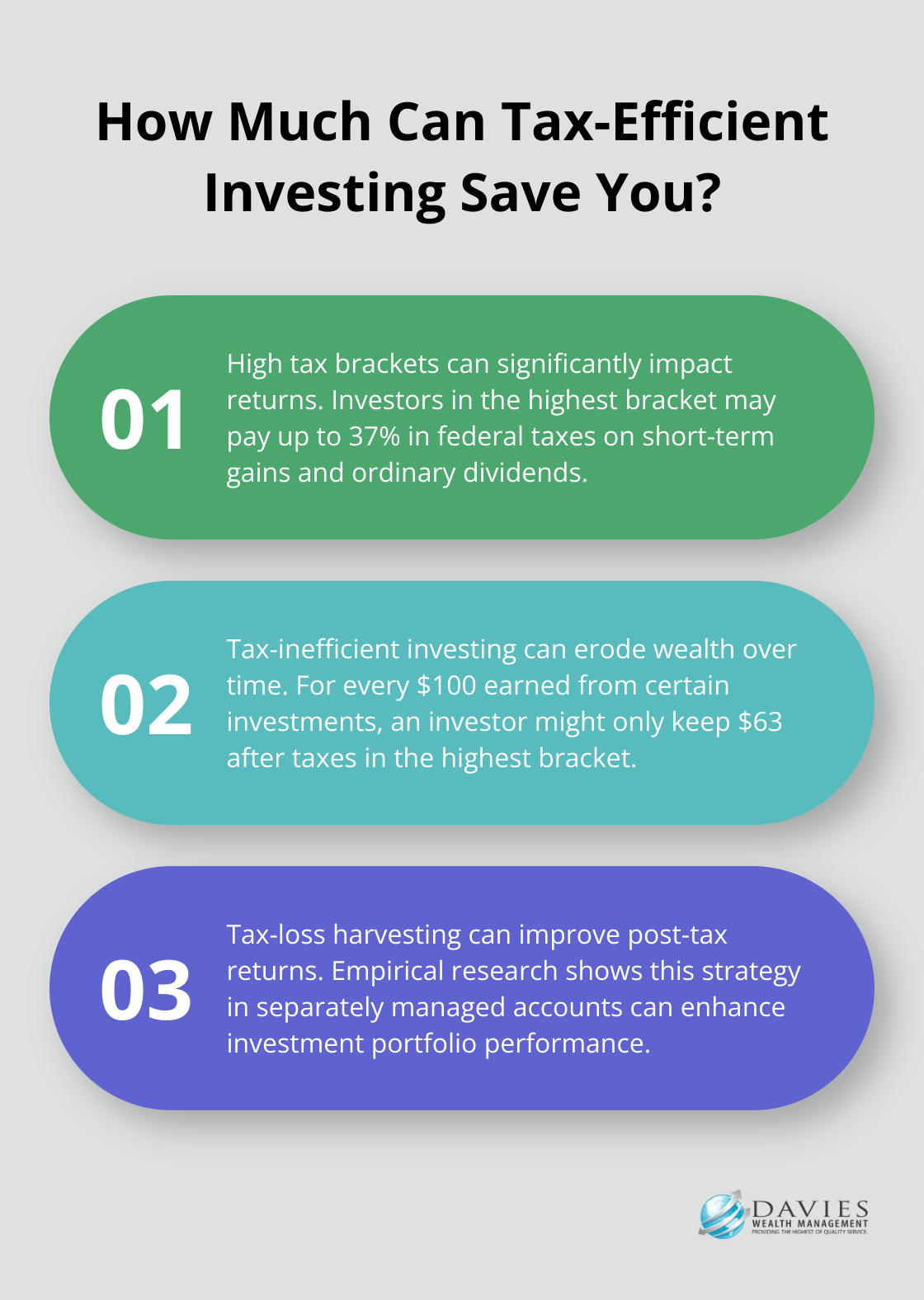

Market Volatility: TRX token value fluctuations may affect net gains.

Regulatory Factors: Lending may be subject to local laws or compliance requirements.

Strategies to Optimize TRX Lending Returns

Diversify across multiple platforms or lending products

Monitor interest rates and market demand for TRX loans

Reinvest earned returns to maximize compounding effects

Choose platforms with strong security and transparency

Conclusion

TRX crypto lending returns provide an effective way to grow TRON-based holdings through passive income while supporting the ecosystem. By selecting secure platforms, diversifying lending strategies, and leveraging compounding, investors can maximize TRX returns while managing risk. Crypto lending is a practical addition to any TRON-focused investment strategy.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...