TRX Investment Diversification Benefits: Optimizing Returns in the TRON Ecosystem

Diversification is a cornerstone of sound investment strategy, and TRX investment diversification benefits are particularly evident in the dynamic TRON blockchain ecosystem. By spreading TRX holdings across multiple products and platforms, investors can reduce risk while enhancing opportunities for growth.

What Is TRX Investment Diversification?

TRX investment diversification involves allocating assets across different TRON-based financial instruments, such as staking pools, lending platforms, liquidity provision, and tokenized assets. This strategy reduces reliance on any single platform or asset, helping investors manage risk effectively.

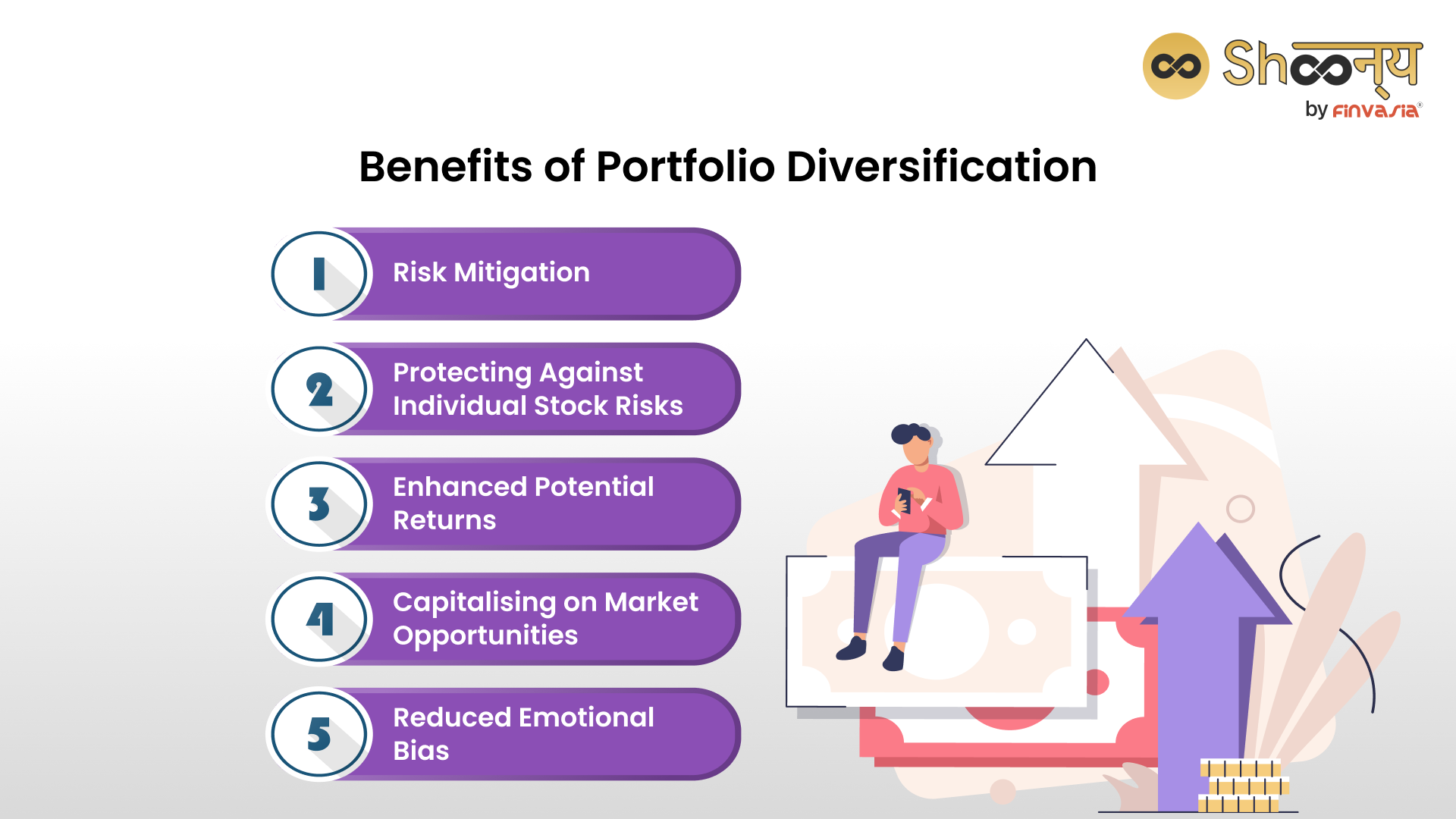

Key Benefits of Diversifying TRX Investments

Risk Mitigation

Diversification spreads exposure across multiple platforms and asset types, reducing the impact of underperformance or platform failures.Stable Returns

Combining low-risk products like staking with higher-yield opportunities balances overall portfolio performance and smooths earnings.Access to Multiple Income Streams

Investors can earn through staking rewards, lending interest, liquidity fees, and tokenized asset dividends simultaneously.Enhanced Liquidity Management

Allocating TRX across assets with varying lock-up periods allows for both long-term growth and ready access to liquid funds.Optimized Portfolio Growth

Diversification enables compounding of returns from multiple sources, accelerating overall TRX wealth accumulation.Flexibility and Strategic Rebalancing

Investors can periodically adjust allocations based on market trends, risk tolerance, and performance metrics to maintain optimal balance.

Practical Diversification Strategies

Mix Product Types: Combine staking, lending, DeFi pools, and tokenized assets.

Multi-Platform Allocation: Avoid concentrating all TRX on a single platform.

Incorporate Stablecoins: Balance TRX with stablecoins like USDT for risk management.

Regular Monitoring and Rebalancing: Track returns and adjust holdings to maintain strategic balance.

Considerations and Risks

Understand platform-specific fees and reward structures.

Ensure platforms are secure and have audited smart contracts.

Be aware of lock-up periods that may affect liquidity.

Monitor regulatory developments affecting TRON-based products.

Conclusion

The benefits of TRX investment diversification are clear: reduced risk, stable returns, multiple income streams, and optimized portfolio growth. By strategically allocating assets across various TRON-based products and platforms, investors can build resilient portfolios that capitalize on the TRON ecosystem’s opportunities while mitigating exposure to volatility or platform-specific risks.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...